How To Read Cot Report Forex

In this article you can learn how to analyze the cot data, a weekly released report with a breakdown of aggregate positions held by three different types of forex traders. One way to gauge market sentiment extremes is through the commitment of traders report.

Forex Cot Charts Forex Bible System V3

Forex Cot Charts Forex Bible System V3

Commodity traders have access to a special market report each week that provides a snapshot of the positions of large institutional traders and small speculators in each commodity futures category.

How to read cot report forex. How to use the cot report in forex trading? Traders were the most bullish on gbp since may 2018. The report can be found at www.cftc.gov and it provides a breakdown of each tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the cftc.

Weekly cot report guide cftc (us commodity futures trading commission) provide a weekly report on market positioning among groups of traders called the commitments of traders (cot) report. Although it is measured in the futures market, it can still help forex traders. The report is prepared by the commodity futures trading commission (cftc).

The cot report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs.issued by the commodities futures trading commission. Read on to understand how this useful report. After talking to many day traders i notice that most of them discount the commitments of traders report as a functional leading indicator.they are of the opinion that the data reported lags five days hence is invalid.

How to read the commitment of traders report first, we start by pulling up the information about the sp500 futures positions in the past week (as of june 26, 2017…data changes weekly). It is published by the commodity futures trading commission and released every friday, around 2.30 pm est. I use tradingster.com for these charts as they lay them out a lot cleaner than the source data at the cftc.

The cot report can provide a window into what large institutional traders are doing. Learn where to get it, how to read it and what. Read our guide on how to interpret the weekly cot report.

Just by using the cot as an indicator, you could have caught two crazy moves from october 2008 to january 2009 and november 2009 to march 2010. The cftc publishes a range of cot reports on a weekly basis. For example, in the week ending july 26, 2016, managed money increased short position in futures and options by nearly 38k contracts while reducing short position in futures and options by slightly more than 14k contracts.

However, as forex traders, we need to only pay attention to the current legacy report. The commitment of traders (cot) report is an extremely valuable volume indicator for forex traders. When used properly, the cot report can give you valuable insights into what is going on in the markets.

The commitment of traders report, which from now on, we will refer to as the cot for convenience, is a series of reports gathered by the cftc (u.s. As forex traders, it is our job to gauge what the market is feeling. Because the cot measures the net long and short positions taken by speculative traders and commercial traders, it is a great resource to gauge how heavily these market players are positioned in the market.

Cot reports provide a breakdown of each tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the cftc. As the original report is in numerical format, we take this data and represent it visually help traders assess market sentiment, trend strength or highlight. How to read the commitment of traders report.

Most importantly, the cot report lets forex traders know the positions of big players in the markets like hedge funds (leveraged funds). Cot report (commitment of traders report) is one of the most relevant pieces of information when it comes to understanding the role that volume plays in forex. ( cot ) commitments of traders report is the most powerful leading indicator.

Many people wonder how to read the cot report. If you had seen that speculative traders’ short positions were at extreme levels, you could have bought eur/usd at around 1.2300. The simple explanation of using the cot report in forex trading is based on commercial traders (big institutional traders) behavior.

The information released by the cftc is somewhat cryptic, which makes learning how to read the cot report, a minor challenge. When the spread between commercial traders and large investors is big, we should expect a market reversal. A complete guide to understanding cot data for forex trading.

How to read the cot report. Cot reports are used by many speculative traders to help making decisions on whether to take a long or short position. Cot is a weekly report released every friday at 3:30 am est by the cftc listing current contract commitments (including currency futures contracts) for the prior tuesday.

It is an excellent trading tool and can be used as an indicator for analyzing market sentiment. As of tuesday 7 th january: To be specific, we need to interpret the futures only short format of the chicago mercantile exchange.

This is a great way to identify the trend. Commodity futures trading commission) on a weekly basis, published every friday at 3:30 e.t., and reflecting the breakdown of positions held by the different types of traders trading futures and. The commodity futures trading commission, or cftc, publishes the commitment of traders report (cot) every friday, around 2:30 pm est.

The commitment of traders report, also known as the cot report, is a weekly sentiment indicator that tracks and provides forex traders with important information on the positioning of currency pairs. How to read the cot report and use it in forex trading? The commitment of traders report, or cot report for short, is made by the us commodity futures trading commission (cftc) and released every friday at 15:30 east coast time.

The commitment of traders (cot) reports show futures traders’ positions at the close of (usually) tuesday’s trading session. Once the page has loaded, scroll down a couple of pages to the “current legacy report” and click on “short format” under “futures only” on the “chicago mercantile exchange” row to access the most recent cot report. Its significance lies in the fact that it gives a unique look into what are traders doing all across the market.

Forex Factory Report Forex Ea Generator 5 Crack

Guide to S&SFX Commitment of Traders Analytical Charts

Weekly Report Archives Page 2 of 6 Leo Hermoso

Weekly Report Archives Page 2 of 6 Leo Hermoso

Weekly Report Archives Leo Hermoso

Weekly Report Archives Leo Hermoso

(PDF) Financial Markets Observatory Lab. Notes and charts

(PDF) Financial Markets Observatory Lab. Notes and charts

Forex Factory Report Forex Ea Generator 5 Crack

Weekly COT report Analysis + Trade Ideas Page 458

Forex Cot Charts V Save Fx Trading

Forex Cot Charts V Save Fx Trading

Weekly COT report Analysis + Trade Ideas Forex Factory

Using the Commitment of Traders (COT) Report in Forex Trading

Using the Commitment of Traders (COT) Report in Forex Trading

Forex Cot Report Data Proven Forex Trading System

Forex Cot Report Data Proven Forex Trading System

Forex Cot Charts V Save Fx Trading

Forex Cot Charts V Save Fx Trading

29 Jan 2nd Feb of 2018 Forex Review COT Analysis

29 Jan 2nd Feb of 2018 Forex Review COT Analysis

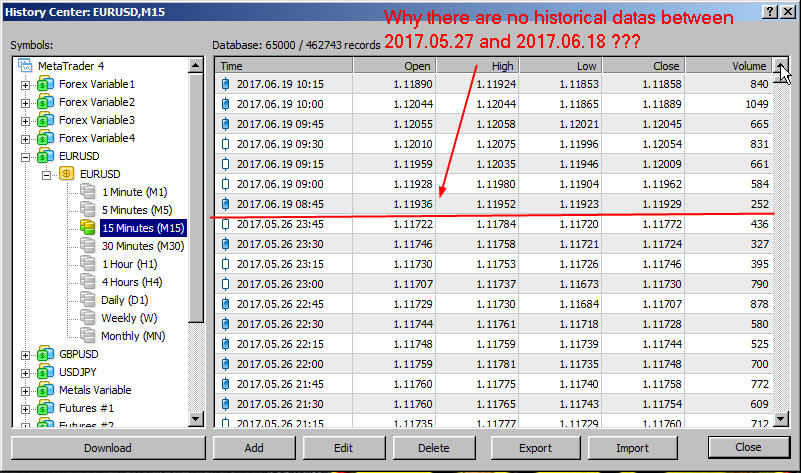

Forex Weekly Historical Data Forex Best Scalping Indicator

Forex Weekly Historical Data Forex Best Scalping Indicator

Forexlive Commitment Of Traders Zigzag Ea Forex Download

Forexlive Commitment Of Traders Zigzag Ea Forex Download

Forex Cot Charts Forex Bible System V3

Forex Cot Charts Forex Bible System V3

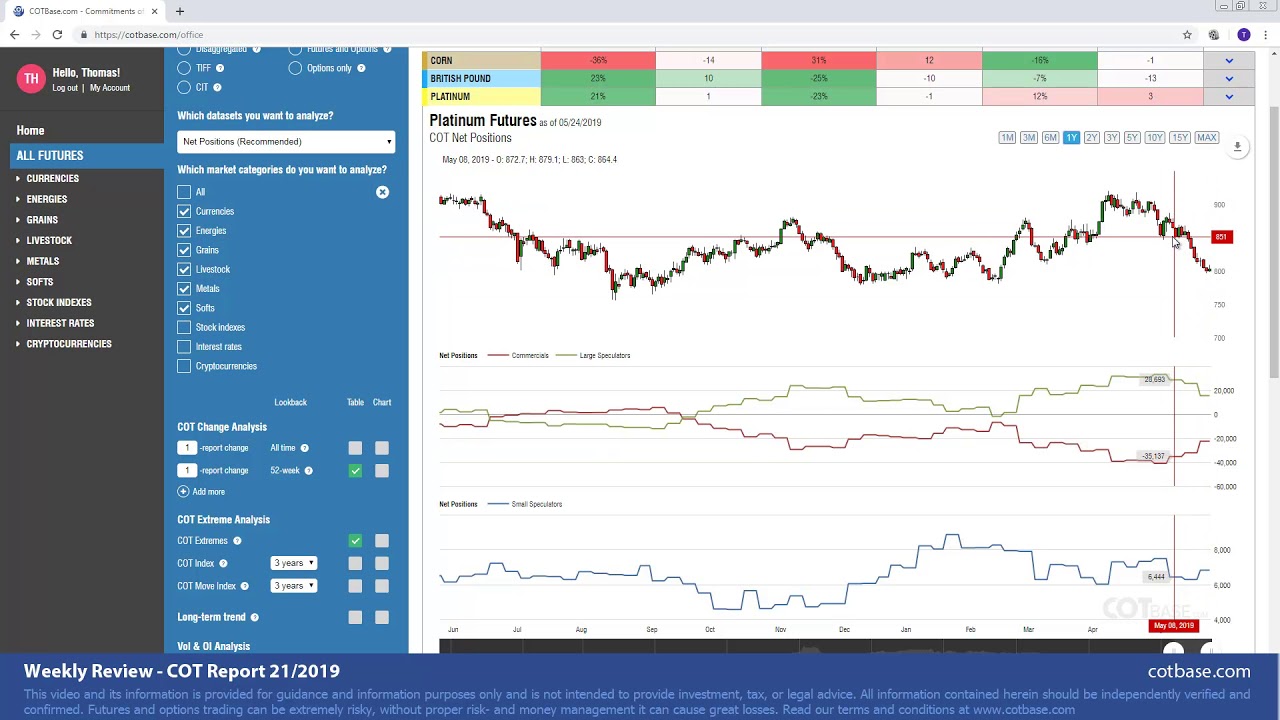

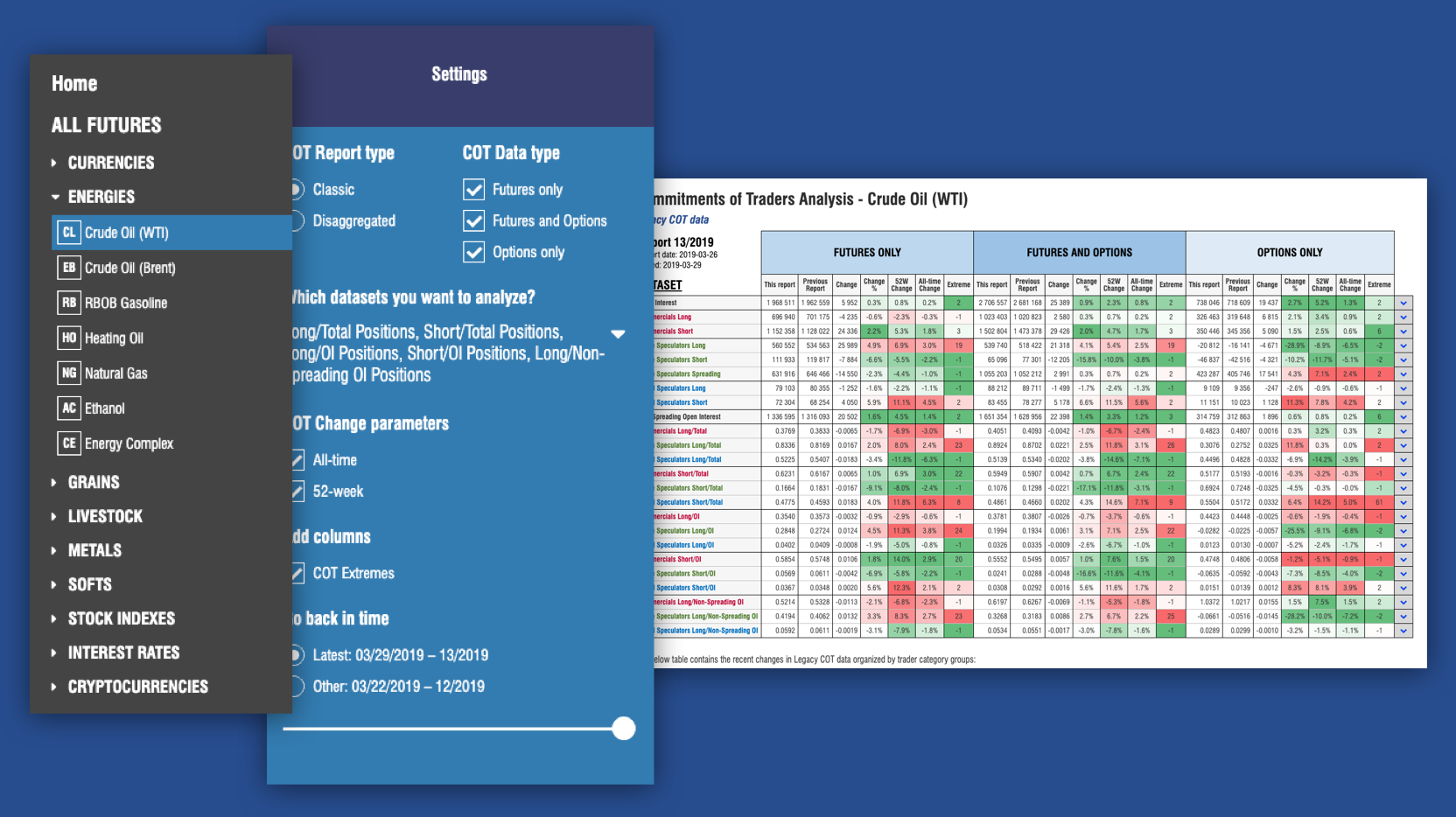

COT Trading Software Free cot charts cot software

COT Trading Software Free cot charts cot software

Forex Cot Data Forex Trading What Is It

Commitment Of Traders Report Guide

Commitment Of Traders Report Guide

Comments

Post a Comment